Stock fair value calculator

The Automobile Benefits Online Calculator for 2018 and subsequent years at Automobile Benefits Online Calculator Disclaimer. The fair value displayed will be in the same currency that was used for EPS and Cashflow per share.

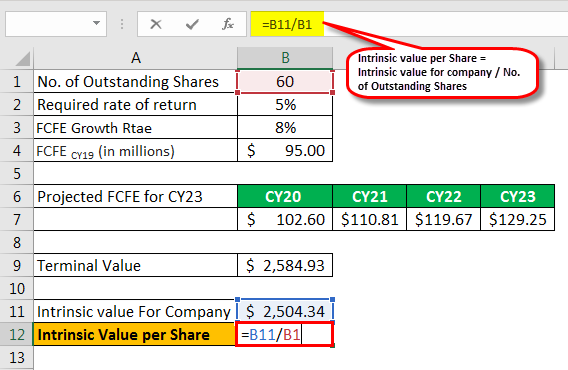

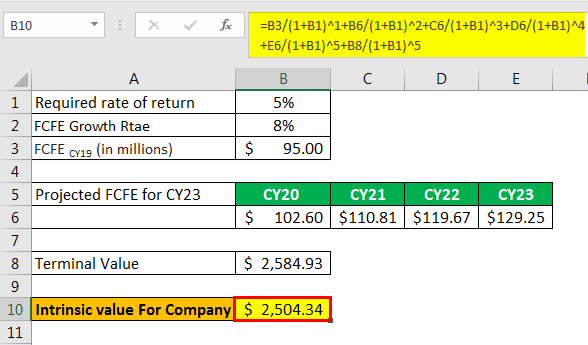

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

Well find the Intrinsic valuefair value of ITC using the above FAIR VALUE CALCULATOR.

. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The company cites the decline in income to non-cash net unrealized derivative fair value losses of C850 million compared with a gain of C242 million in the prior-year second quarter. After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning.

There are four basic methods of determining fair market value. Simply go to the portal and search for the. The index dividend yield weight in the index and capitalization.

Fair Market Value Calculator. Keep the discount rate at eleven percent and then see what happens to the theoretical stock value as you adjust the long-term growth. Use the fair market value FMV.

They go as follows. A calculator facilitates program trading what-if analyses. In my calculator lynchs value between 1- 2 is Fair-Value.

If you have a fair idea of what kind of return you can get on a particular asset then you can use the future value calculator to figure out its future value. The current share price of ITC is Rs 209 March 2021. Stock Options.

You can also compare investments with the help of a future value calculator. My result for the fair value of Apple is 28157 USD Note. This calculator finds the fair value of a stock investment the theoretically correct way as the present value of future earnings.

Cost or selling price. Program trading values Fair value index arbitrage values and program trading probability graphs are updated daily. Divide the intrinsic value by the conversion ratio to find the value of one warrant.

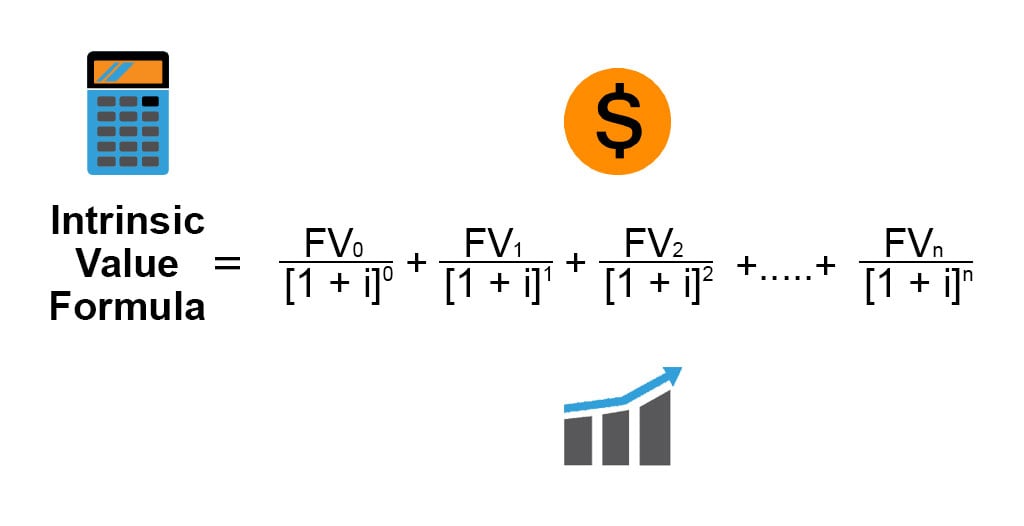

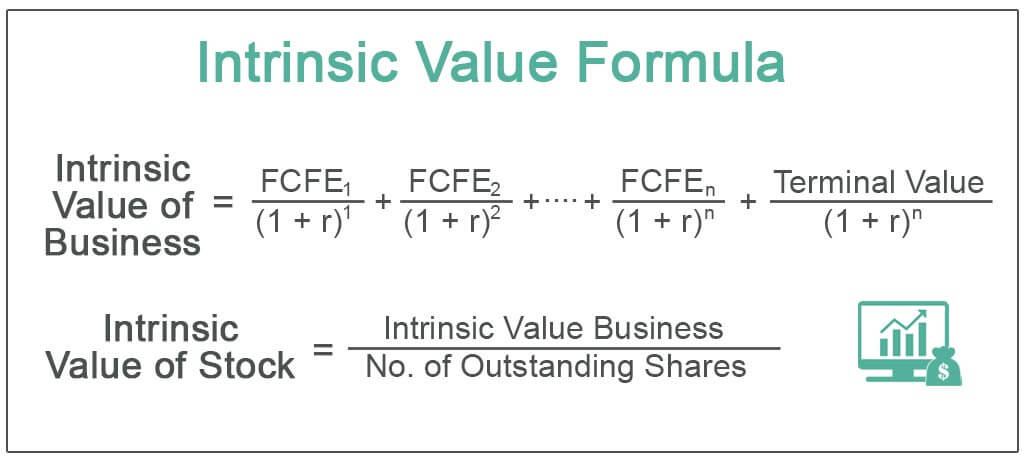

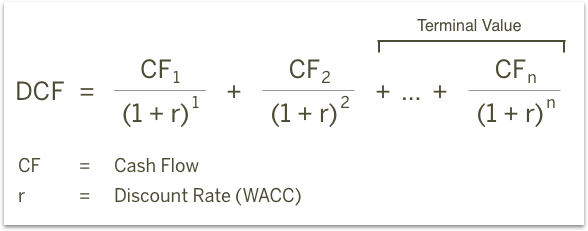

Firstly we will uncover how Warren Buffett calculates Intrinsic Value using the Discounted Cash Flow Model DCF. The spread the difference between the stock price when you exercised and your strike price will be taxed as ordinary incomeBecause Meetly our example company let you buy the stock for 1 at a time when the fair market value had risen to 5 its almost like they paid you that 4 difference along with your income and salary. Taking the square root of that intermediate value then suggests a reasonable valuation.

If you did it correctly the calculator will show you the Fair Value of Apple Inc. Both the parties buyers and sellers are reasonably and equally knowledgeable about the asset under consideration. This gives you the fair value price you should pay for a stock.

Your cost basis is 5000. So lets say you purchased 100 shares of XYZ stock at 50 a share. Online Calculators Financial Calculators Stock Profit Calculator Stock Profit Calculator.

Sales of comparable assets. Many ESPPs provide for a delay in the acquisition of the shares. For many real estate calculations you have an exact number.

One warrant is thus worth 2. Qualified ESPPs known as Qualified Section 423 Plans to match the tax code have to follow IRS rules to receive favored treatment. To make a more accurate interpretation of his fair value ratio I added an extra step for Lynchs values below 1.

A Discounted Cash Flow Calculator which uses estimated future earnings or cash flow growth to estimate the fair value of a stock or investment. Fair market value FMV is the price at which one can purchase an asset under normal market conditions. In this example if the conversion ratio equals five you have 10 divided by five.

In my interpretation if the value is less than 05 I call it VERY Over-Valued. How to use the Stock intrinsic value calculator. Checking the future value of your money using a future value calculator can help you make an informed decision.

The fair market value represents the accurate valuation of asset under the following conditions. You can find the TTM EPS of any publically listed stock at Trade Brains Portal. It can also be calculated by taking the difference between the intrinsic value and the premium of the option which means the sum of time value and intrinsic value would be the options premium.

The Intrinsic Value or Fair Value of stock estimates a stocks value without regard for the stock markets valuation. You can calculate the number of square feet in a house or the number of bedrooms with relative ease. Unfortunately theres no set formula for determining the fair market value of a property.

The stock eventually rose to 2432 per share allowing the Oracle of Omaha to exercise those warrants for more than 17 billion reflecting a 12 billion gain on the original investment. You can find company earnings via the box below. Ie for an amount that is less than the value of the stock at the time of the acquisition of the shares.

What is the Fair Market Value. If the item has been recently bought or sold that can be a good indicator of its fair market value. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

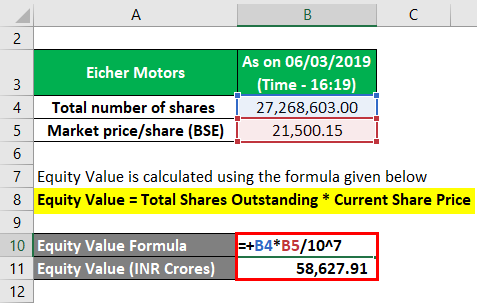

Index metrics include stock listings sorted by price change vs. When a real estate agent presents a prospective home seller with a list of recent sales prices for similar. During the trailing twelve months the EPS TTM of the company is Rs 1059.

The final step is to compare the calculated fair value of the stock with the traded price of the stock. The simple stock calculator has options for buying price and selling price as well as trading commissions for each trade. The most significant implication for employees is a 25000 benefit.

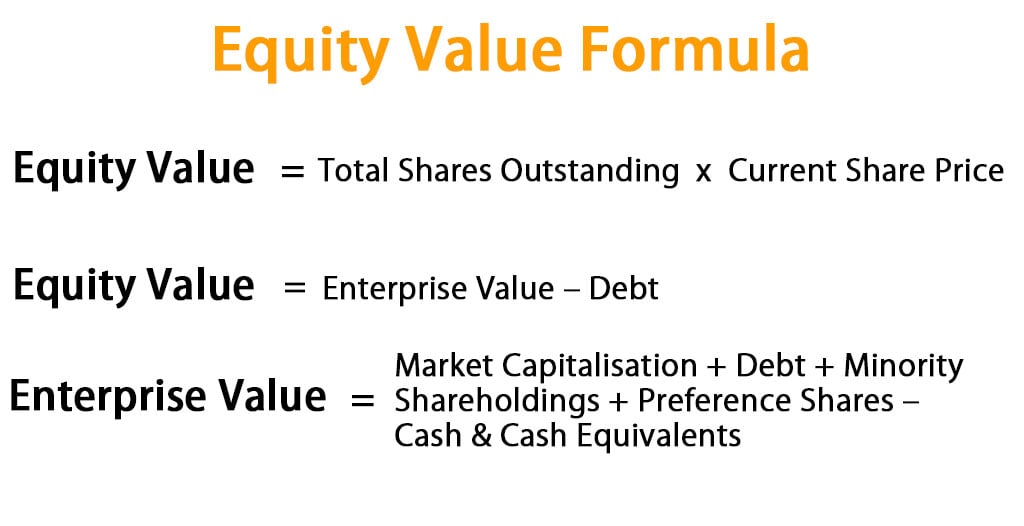

In the original formulation EPS uses a multiplier of 15 while BVPS is assigned 15 and the resulting number is the Fair Value of the stock. Assessing Fair Market Value. Now the stock is 80 a share and you give it as a.

A Dividend Discount Model Calculator which also estimates net present value like the DCF calculator. I have clarified what it means when the lynchs fair value is 15. The output from the equation is the highest price where a stock is reasonably valued according to Graham.

An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount. The simple answer to your question is no the value of a gift of stock for gift tax liability is NOT the donors cost basis but rather the fair market value of the stock at the time the gift is given. Options are purchased by investors when they expect the price of a stock to go up or down depending on the option type.

For example if a stock currently trades at 40 and an. Many online stock brokers now offer commission free trades the. Stock profit calculator to calculate the total profit or loss on any stock that you buy and sell.

You wouldnt buy a stock without knowing the spot. Their lofty price targets. Using the ESPP Tax and Return Calculator.

There can be many ways to calculate the time value and this can be calculated by using the calculator we have provided below.

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Benjamin Graham Formula Stock Valuation Old School Value

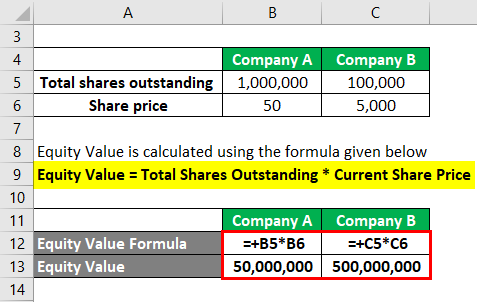

Equity Value Formula Calculator Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Equity Value Formula Calculator Excel Template

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Fair Value Meaning Formula Stocks How To Calculate

Present Value Of Stock With Constant Growth Formula With Calculator

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Fair Value In Stocks Definition Advantages And Examples

Equity Value Formula Calculator Excel Template

Benjamin Graham Formula Stock Valuation Old School Value

Value Shares With Graham S Formula

Fair Value Calculator Trade Brains